Geithner lays a toid on R.E. market

- Thread starter ClintClint

- Start date

-

Trouble logging in? Send us a message with your username and/or email address for help.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

New posts

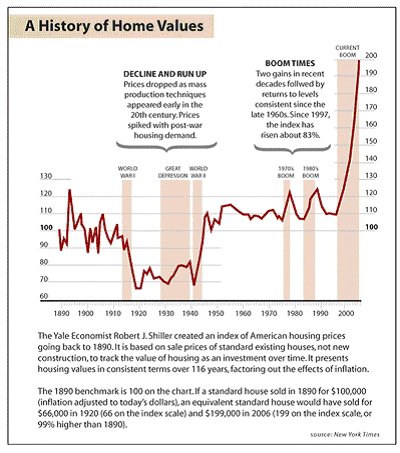

Thanks as always SHELLY. The chart looks to mean that the value of a home should be tied to a baseline of the rate of inflation? I think that is what the chart is showing me. If that's the case then it has never been a good investment, ever. Why would a person buy something on credit that they hope will be worth what they paid for it in 30 years?

Yep - this is 'What the Market Will Bear' market. And, our economy is correcting itself......always will....keep the government out of it and allow the markets to do their work naturally.

I believe values may correct to 1999 levels. I don't remember what percentage that would represent but I think we have a long ways to go. Most properties on the market today are severely overpriced, many at their 2005/2006 prices. A reckoning has to occur. This may be the year or perhaps 2010.

...maybe to "provide a roof over their family's head, keep them out of the cold and paint the walls any color they wish?"

...maybe to "provide a roof over their family's head, keep them out of the cold and paint the walls any color they wish?"

Believe it or not, there once was a time when people regarded their house as a "home for themselves and their family" and not an "investment" or "ATM."

That's exactly the answer I wanted to hear. I think hearing you say it after you were the one who originally posted the piece gives it more relevance too.

I've been wondering as of late: Have we built more residences in America than there is population to use it? If we have, we may wait a generation to see inventory eaten up by users or attrition.

The equation: What is the numerical difference between America's homeless population and America's vacant housing?

...I'm not sure where it is at this very moment--but I guarantee the divergence rate of the two are accelerating daily.

New posts

Equity extraction

It is not so much how much homes have appreciated, which has been unprecendented. Really what the the kicker is the amount of equity extraction that occured during the boom times. Current figures are around 300 billion, and we are talking about home equity extraction when homes where in the stratospheric price range. This amount is unprecendented in any of our mini housing booms in U.S. history. So the majority of the homebuyers put next to nothing down, then started the extracting the equity from all already insanely spiraling upward home prices.

Typical scenario- buy something at 750,000, whose "true" value, within historic appreciation limits maybe 250,000-350,000. Of course after they bought the house 4 months later homebuyer goes to the bank and gets $50,000 HELOC from the appreciation home - now valued at a rock-smokin 800,000. What does he or she do? Takes that HELOC and buys a drop-top BENZ. And it don't stop. It was a piggybank. In 05' I wondered where in the hell are these people obtaining that kind of lifestyle. So we are in uncharted waters-no references to anything in our history has ever occured in our history. Japan is a very good example of the same scenario that happened here. Real estate prices today there, mind you in nominal dollars terms from the peak prices of the mid to late 80's, are about even in the best case scenario, some scenarios still down 20 -40%.

This economic downturn is called the "worst since the Great Depression" Does anyone onBoard know how low the real estate trough went during the GD and how long before it recovered to pre GD pricing?

It is not so much how much homes have appreciated, which has been unprecendented. Really what the the kicker is the amount of equity extraction that occured during the boom times. Current figures are around 300 billion, and we are talking about home equity extraction when homes where in the stratospheric price range. This amount is unprecendented in any of our mini housing booms in U.S. history. So the majority of the homebuyers put next to nothing down, then started the extracting the equity from all already insanely spiraling upward home prices.

Typical scenario- buy something at 750,000, whose "true" value, within historic appreciation limits maybe 250,000-350,000. Of course after they bought the house 4 months later homebuyer goes to the bank and gets $50,000 HELOC from the appreciation home - now valued at a rock-smokin 800,000. What does he or she do? Takes that HELOC and buys a drop-top BENZ. And it don't stop. It was a piggybank. In 05' I wondered where in the hell are these people obtaining that kind of lifestyle. So we are in uncharted waters-no references to anything in our history has ever occured in our history. Japan is a very good example of the same scenario that happened here. Real estate prices today there, mind you in nominal dollars terms from the peak prices of the mid to late 80's, are about even in the best case scenario, some scenarios still down 20 -40%.

Thanks as always SHELLY. The chart looks to mean that the value of a home should be tied to a baseline of the rate of inflation? I think that is what the chart is showing me. If that's the case then it has never been a good investment, ever. Why would a person buy something on credit that they hope will be worth what they paid for it in 30 years?

There's nothing the government can do, prices fall because people aren't willing to buy. The market that created this doesn't exist anymore, the only direction for the market to go is down down down. Government should do it's best to stabalize the banks, but as far as housing is concerned it should just step out of the way and let the market naturally correct. It's going to do that no matter what, the only thing government might be able to do is prolong the agony. Who wants that?

Yep - this is 'What the Market Will Bear' market. And, our economy is correcting itself......always will....keep the government out of it and allow the markets to do their work naturally.

The reduction

Looks like the "market" might accept a 70% reduction in home values. Does anyone think that is a reality? I don't. but if it is true there is a LOT of money to be made out there.

Looks like the "market" might accept a 70% reduction in home values. Does anyone think that is a reality? I don't. but if it is true there is a LOT of money to be made out there.

Thanks as always SHELLY. The chart looks to mean that the value of a home should be tied to a baseline of the rate of inflation? I think that is what the chart is showing me. If that's the case then it has never been a good investment, ever. Why would a person buy something on credit that they hope will be worth what they paid for it in 30 years?

Looks like the "market" might accept a 70% reduction in home values. Does anyone think that is a reality? I don't. but if it is true there is a LOT of money to be made out there.

I believe values may correct to 1999 levels. I don't remember what percentage that would represent but I think we have a long ways to go. Most properties on the market today are severely overpriced, many at their 2005/2006 prices. A reckoning has to occur. This may be the year or perhaps 2010.

I don't think that housing is that overpriced - 70% is a huge drop. I could see it happening in some major "boom" condo spec markets where the value was all on paper and hype, but I don't see a 70% drop in home prices across the board - maybe 30%.

Why would a person buy something on credit that they hope will be worth what they paid for it in 30 years?

...maybe to "provide a roof over their family's head, keep them out of the cold and paint the walls any color they wish?"

...maybe to "provide a roof over their family's head, keep them out of the cold and paint the walls any color they wish?"Believe it or not, there once was a time when people regarded their house as a "home for themselves and their family" and not an "investment" or "ATM."

Last edited:

...maybe to "provide a roof over their family's head, keep them out of the cold and paint the walls any color they wish?"

Believe it or not, there once was a time when people regarded their house as a "home for themselves and their family" and not an "investment" or "ATM."

That's exactly the answer I wanted to hear. I think hearing you say it after you were the one who originally posted the piece gives it more relevance too.

I've been wondering as of late: Have we built more residences in America than there is population to use it? If we have, we may wait a generation to see inventory eaten up by users or attrition.

The equation: What is the numerical difference between America's homeless population and America's vacant housing?

The equation: What is the numerical difference between America's homeless population and America's vacant housing?

...I'm not sure where it is at this very moment--but I guarantee the divergence rate of the two are accelerating daily.