Shelly, I do not profess to understand economics as well as you at all, but I am curious how you think that a drop in the Fed rate would cause hyper-inflation and send the dollar straight to he!!?

I was always under the understanding that the drop in the value of the dollar had more to do with with a drop in foreign investment in part because of the tax implications and the difficulty for foreigners due to the Patriot Act and one other Bush induced Act.

Lowering the fed funds target rate (the rate that banks charge each other) carries over into the interest rates banks charge consumers to borrow money.

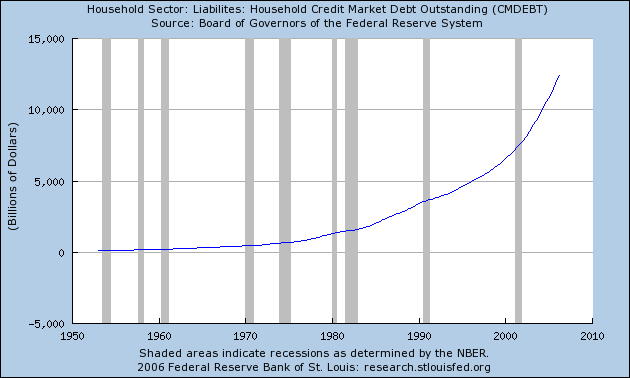

The "cheaper" the money is to borrow =

the more folks want to borrow =

the more money floods into the system =

more money chasing fewer goods =

creating increased demand for a decreasing supply =

increasing prices for the few goods available = INFLATION.

It shouldn't be a surprise to many that we are experiencing smoldering inflation at this very moment (or haven't you notice the price increase in your grocery or utility bill in the last year or so). Presently, the economy and jobs are <supposedly> doin' swell--in that scenario, if the fed drops the rates, money will flood the market and really fire up inflation (which the Fed says is its number one concern).

Foreign money will find it's way to a country that will pay the highest interest rates. The RE investor wants/needs cheap money to leverage their habit and foreign saver wants to get the most return for their savings. If foreigners don't like the rate the US is paying, they'll take their money elsewhere. Any news item that "suggests" that the Fed might even "think" about dropping interest rates (increasing unemployment rates, decreasing productivity, etc.) has sent the dollar lower. The dollar has already weakened on the news that some countries, like the United Arab Emirates (the 3rd largest oil producer in OPEC) is converting some of its reserves from US dollars to Euro; additionally, some oil-producing countries are mulling over pricing their oil in Euro vs. the US$ which will cause further weakening. If the US attempts to drop interest rates on a weakening dollar, it will send holders of the US currency screaming for the exits causing the dollar to plunge even further.

Since foreigners hold 52% of the US debt, the Fed will think twice about ruffling their feathers, lest they do a dollar dump and become reluctant to buy our debt in the future. Raising interest rates will make the US debt more attractive to foreign savers while at the same time, keeping a lid on inflation. I believe any fed target rate going forward into next year will be an increase--the US would have to be in hurting status (or economic meltdown) if the Fed sees a reason to decrease the rates at this juncture--and no, saving "Joe Presale-Condo" doesn't constitute an economic meltdown. IMO

.